产品系列

手机数码配件领跑者,时尚随心,快乐随行。long8·唯一

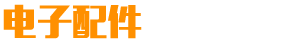

long8·唯一是电子元件和小型的机器、仪器的组成部分,其本身常由若干零件构成,可以在同类产品中通用;常指电器、无线电、仪表等工业的某些零件,是电容、晶体管、游丝、发条等电子器件的总称。常见的有二极管等。电子元器件包括:电阻、电容、电感、电位器、电子管、散热器、机电元件、连接器、半导体分立器件、电声器件、激光器件、电子显示器件、光电器件、传感器、电源、开关、微特电机、电子变压器、继电器、印制电路板、集成电路、各类电路、压电、晶体、石英、陶瓷磁性材料、印刷电路用基材基板、电子功能工艺专用材料、电子胶(带)制品、电子化学材料及部品等。电子元器件在质量方面国际上有欧盟的CE认证,美国的UL认证,德国的VDE和TUV以及中国的CQC认证等国内外认证,来保证元器件的合格。 阅读更多